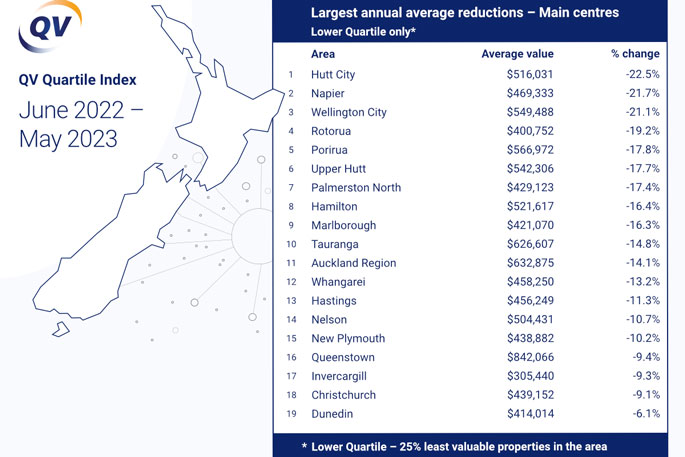

Home values have fallen further on average at the bottom of the property ladder than at the top, according to the latest numbers from QV.

The QV Quartile Index tracks the value movements of the 25 per cent most and least expensive houses across the country's main urban centres.

It shows values in the lower quartile have fallen by an average of 14.6 per cent across the main centres in the last 12 months, compared to an average reduction of 12 per cent in the upper quartile.

QV operations manager James Wilson says that while the mean average home value reported in the monthly QV House Price Index was a useful gauge of what's happening in the residential property market, breaking the market down further into quarters gives us even greater insight into what's happening at both ends of the market.

'This analysis is interesting as it provides insight into what has been occurring beneath the surface of the housing market over the last 12 months.

'These results reveal the effect that sales composition can have on the housing market, with many areas seeing a greater amount of sales transacting at the lower end of the price brackets compared to the same time 12-18 months ago.”

He says this has the effect of ‘skewing' value levels in most areas downwards, as a greater number of lower price sales are represented in sales volume.

'These results are supported by analysis of buyer activity, which reveals that more first-home buyers have been active in many areas compared to investors and owner occupiers, who have taken a more cautious ‘wait and see' approach as the downturn has progressed.

'First-home buyers typically target entry-level stock, much of which is priced in the lower quartile bracket. Over the past year or more, this stock has often been purchased from investors looking to consolidate their portfolios in this high interest rate environment with less capital growth available.”

Lower quartile home values have fallen further on average in 12 out of 19 main urban centres since April last year, and in more than half of the country's council areas nationwide.

Of the largest cities, they have fallen the furthest in Lower Hutt (-22.5 per cent), Napier (-21.7 per cent), and Wellington City (-21.1 per cent). They have fallen the least in Christchurch (-9.1 per cent) and Dunedin (-6.1 per cent).

'It is important to note that sales volumes are still extremely suppressed, which can make longer term trends more difficult to determine,” says Wilson.

'It will be interesting to see whether this trend continues when we do eventually see activity levels begin to rise once more.

'We would expect that when investors do eventually re-enter the market again, competition for entry-level stock will increase along with values. In the meantime, the recent increase of the OCR rate by another 0.25 per cent may continue to act as a headwind on investor activity, although many banks may have already baked it into their interest rates.”

0 comments

Leave a Comment

You must be logged in to make a comment.