New Zealand's average home value is zeroing in on the $900,000 mark following yet another month of widespread declines across the country.

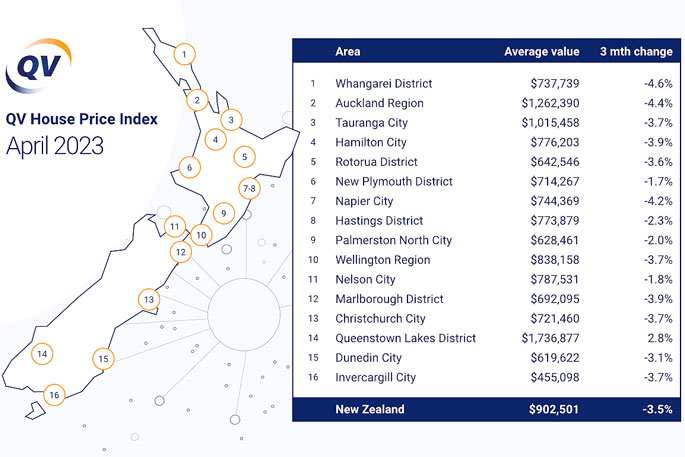

The latest QV House Price Index shows values have reduced by an average of 4.5 per cent throughout the first four months of 2023, including an average reduction of 0.6 per cent in the month of April – a marked improvement on the 1.4 per cent average decline recorded back in March.

The national average home value is now $902,501, which is 13.3 per cent less than the same time last year, but 22 per cent higher than before the Covid-19 pandemic first began here in late February 2020.

The average rate of home value decline has slowed in 10 of the 16 largest urban areas that QV monitors – including in Auckland, where the rolling three-month rate of reduction has slowed from 5.2 per cent in March, to 4.4 per cent in April.

However, it is still the second-largest average home value decline this quarter, after Whangarei (4.6 per cent). Wellington's average rate of home value decline has also slowed to 3.7 per cent this quarter, down from a 4.8 per cent quarterly decline back in March.

"We're seeing a mixed bag of results across the country right now, with the residential property downturn slowing in some centres, yet increasing in others," says QV national spokesperson Simon Petersen.

"The market fundamentals have not changed – credit constraints and high interest rates continue to have a stranglehold on the market – but we are starting to see some small signs that it could be approaching equilibrium.

"Though it's still far too early to say precisely when the downturn will bottom out, the Reserve Bank's recent proposal to ease mortgage loan-to-value ratio restrictions, coupled with additional changes to the treatment of expenditure in application processes, could certainly bring some buyers back into play.

"Immigration is also continuing to ramp up in the background, fuelling demand for housing. These things won't revitalise the real estate market overnight, but they may provide some relief at a time when activity is at historic low levels."

Simon says buyers remain scarce, even as new listings fell to historic lows in April.

"Investors are sitting on their hands for the most part, potentially biding their time while they wait to see what this year's election has in store for them – although continued ‘stalling' of value declines within some of NZ's larger urban areas may begin to entice some who believe that we are at the ‘bottom of the curve' back into the market.

"Owner-occupiers are having to weigh up the considerable challenges and risks of trying to buy and sell in such a difficult market environment. While large numbers of first-home buyers are still being locked out of it altogether due to its unaffordability – the cost of living crisis being a major barrier to saving for a deposit, and then being able to service a mortgage.

"Meanwhile, the real estate market is continuing on its steady climb back down the mountain of very significant home value growth we saw in 2020 and especially 2021.

"It's still a long way off its pre-Covid-19 levels for the most part, but this corrective cycle isn't over yet – it still looks as though the market is destined for a difficult winter ahead."

0 comments

Leave a Comment

You must be logged in to make a comment.